As we reflect on 2020, a year of extremes and contrasts: both within the investment markets, as well as the general economy.

The first six months of 2020 were characterized by world-wide lockdowns following the initial spread of COVID-19, followed by the fastest sell-off in history across many global risk markets.

The second half of the year – in stark contrast – saw a strong recovery in risk markets as investors looked past the pandemic and eyed the extreme fiscal and monetary measures put in place around the world as social and economic activity were curtailed.

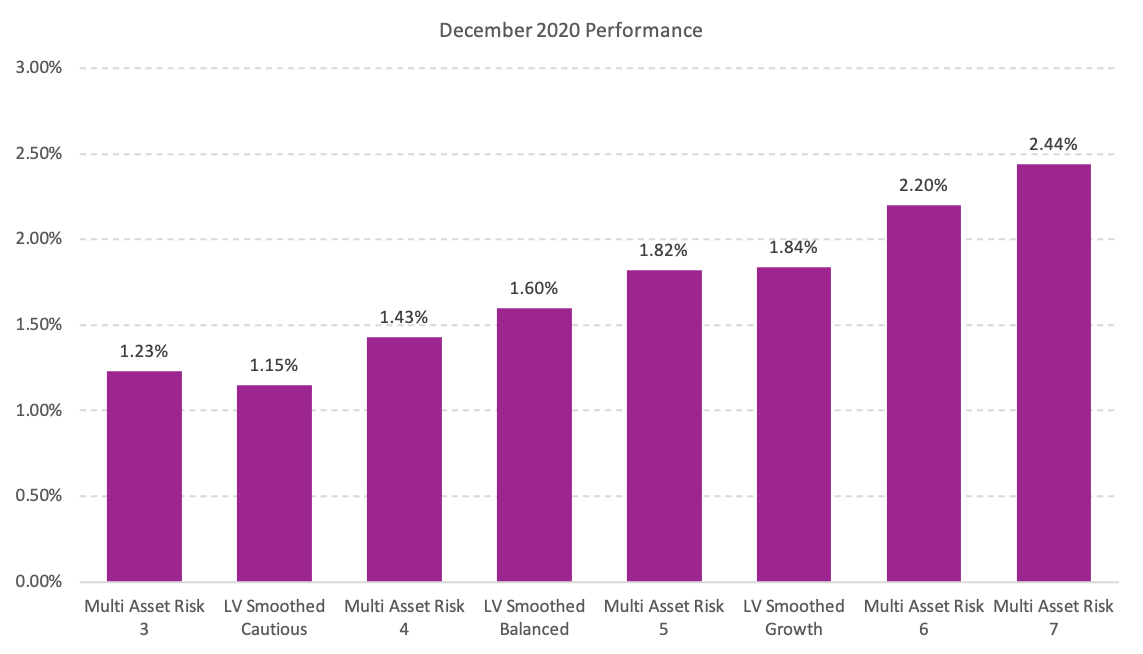

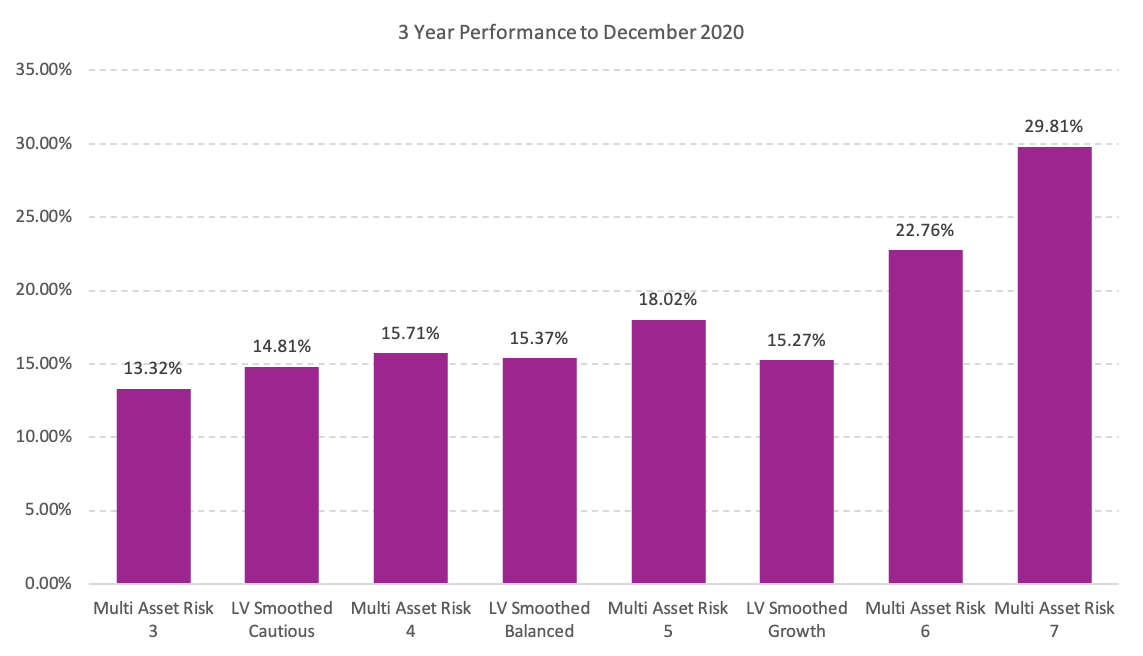

During this time the investment committee has reviewed and monitored the performance of the portfolios and strategies, and it is pleasing to see after early drawdowns in 2020 the multi-asset range closes out the year in positive territory once again.

The diversification of assets around the world has also provided decent risk-adjusted returns, and the asset selection within the portfolios has outperformed broad benchmarks if we take a weighted sector average as the measure.

While equities provided the majority of gains in the second half of the year, fixed income continued to provide portfolios with a stabilizing force and attractive real returns as interested rate policies appear to be set to ‘lower-for-longer’.

Looking ahead to 2021, while many hurdles remain in the path back to normality, and the economy has much healing left to do: the policy measures should provide a foundation for sectors most focused on economic activity to perform well as the world (eventually) re-opens.